In North Dakota, the responsibility for filing probate falls to the estate administrator. An estate administrator is responsible for managing and distributing a deceased person’s assets according to their wishes as outlined in their will.

Becoming an estate administrator requires a few steps and involves understanding the complexity of North Dakota's probate laws. The process starts with submitting an application to the court that has jurisdiction over the estate.

Prospective administrators should also provide a copy of the will, death certificate and proof of identification. Once approved, the applicant must take an oath of office before being officially named as an administrator by the court.

After taking office, it is important for administrators to understand their fiduciary responsibilities to the estate and its beneficiaries which include providing notice to creditors and properly filing all court documents related to probate proceedings in North Dakota.

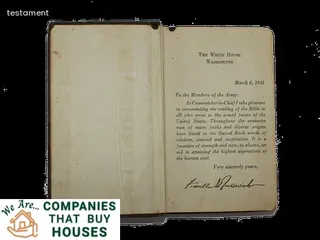

When an estate goes through the probate process in North Dakota, it is the job of the estate administrator to oversee the distribution of assets and liabilities. The court will issue a court order known as letters testamentary that appoints the estate administrator to manage the deceased's financial affairs.

This step-by-step guide outlines what happens when an estate goes through probate in North Dakota and provides helpful information on how to become an estate administrator. The process typically begins with filing a petition with the district court for an order for probate.

This includes submitting a death certificate, will or other documents related to the deceased's assets and liabilities. After this, creditors of the deceased must be notified of their rights under state law, and all debts must be paid from the proceeds of any remaining assets.

Once this is done, any remaining funds are distributed according to state laws concerning intestate succession or according to instructions provided in a valid will. Throughout this process, it is important for an estate administrator to provide updates to beneficiaries throughout all stages of settlement so they can remain informed of progress.

In order to become an Estate Administrator in North Dakota, there are certain requirements that must be met. To begin with, applicants must be at least 18 years of age and be a resident of the state.

You will also need to have an understanding of North Dakota's probate laws and procedures, which can be acquired through a course or apprenticeship program. Furthermore, you will need to submit an application to the Clerk of Court in the county where the estate is located, along with proof of your identity and any other required documents.

Additionally, you may need to take a test or provide a bond before you are officially appointed by the court as an Executor of Estates in North Dakota. Once approved, you will be responsible for managing all aspects of administering estates according to North Dakota law and ensuring that all debts are paid and assets distributed as directed by the decedent's final wishes.

In North Dakota, a will is the initial document used to determine who will take charge of an estate during probate. The appointed person, referred to as an estate administrator, is responsible for ensuring that all assets are identified and distributed according to the testator's wishes.

The probate process begins with the submission of a will to the court and ends when creditors have been paid and all assets have been divided. It is important for any potential estate administrator in North Dakota to understand how their role fits into this process.

A step-by-step guide to becoming an estate administrator in North Dakota can help them prepare for this responsibility by providing information about the duties they may be asked to perform, such as notifying heirs of their inheritance and filing paperwork with the court. This guide can also provide insight into how a will impacts probate in North Dakota by helping them understand how the instructions outlined in it must be followed before any assets can be distributed.

The tax implications of settling an estate in North Dakota can be complex and must be navigated with care. In order to become an estate administrator in North Dakota, it is important to understand the various levels of taxation which may apply to different assets in the estate.

Depending on the size and structure of the estate, taxes such as probate fees, inheritance taxes, and income taxes must all be taken into consideration and managed appropriately. Estate administrators should also consider how certain types of transfers or distributions may affect their tax liability, as well as potential deductions that can be utilized to reduce financial burden on the estate's beneficiaries.

Ultimately, a step-by-step guide to becoming an estate administrator in North Dakota should include careful examination of the tax implications associated with settling the estate.

Probate laws are an important component of estate administration in North Dakota. Before taking on the role of an estate administrator, it is essential to have a comprehensive understanding of all related regulations and guidelines.

Fortunately, there are many resources available to help individuals become familiar with the probate process in North Dakota. The North Dakota State Bar Association provides a comprehensive overview of probate codes and procedures as well as information regarding executors and administrators.

Additionally, the North Dakota Department of Justice has a helpful website that outlines the various forms and documents required for certain types of estates. Additionally, the Office of Attorney General offers a wealth of legal opinions on how best to navigate the probate process in the state.

Finally, local attorneys and financial advisors can provide invaluable insight into relevant laws specific to individual cases.

In North Dakota, a beneficiary can contest the terms of a will if they believe that the will is invalid or that it was not created with the testator's intentions in mind. In order to contest a will, beneficiaries must provide evidence that either indicates fraud or undue influence, or that there are ambiguities within the document that need to be cleared up.

If a beneficiary chooses to contest the will, they must file an objection with the court and serve all parties involved in the estate administration process. It is important to note that North Dakota law limits the time frame in which an individual can contest a will and any objections must be filed before this time has passed.

Estate administrators must also be aware of state laws regarding these matters and have a thorough understanding of how they might affect their work. Becoming an estate administrator requires knowledge of these laws as well as experience in real estate and probate law, so those interested should make sure they have all necessary qualifications before embarking on this career path.

When someone passes away in North Dakota, their financial debts and assets must be managed by an estate administrator. This administrator works with the deceased's creditors to repay any outstanding debts in a timely manner and distributes the remaining assets to beneficiaries according to the terms of the will.

In most cases, the executor of the deceased's will is responsible for carrying out these tasks. To become an estate administrator in North Dakota, there are several steps that must be followed.

Firstly, all paperwork must be filed with the court including a petition for probate and a copy of the will if applicable. The court then appoints an executor who is responsible for notifying creditors and collecting information about any outstanding debts.

It is also necessary to contact all potential heirs or beneficiaries named in the will as well as collect any life insurance proceeds. After all debts have been paid off, assets can then be distributed accordingly.

In North Dakota, there are certain time limits that must be met in order to properly file probate documents. When becoming an Estate Administrator in North Dakota, it is important to be aware of these timeframes and understand the steps necessary to meet them.

Generally, the executor of an estate has 60 days after being appointed by the court to file the probate documents. The estate administrator is also required to provide a written notice of their appointment to all parties involved within 14 days of being appointed.

Furthermore, they must publish notice of their appointment and the opening of the estate within 30 days after receiving letters testamentary or letters of administration from the court. It is essential that these steps are taken and all deadlines are met when working as Estate Administrator in North Dakota in order for probate documents to be filed correctly and on-time.

When it comes to filing and handling probate matters in North Dakota, there are fees associated with the process. For example, if you are an estate administrator, you will need to pay a fee for filing the will and other documents.

In addition, the court may require additional fees for office services, copies of documents and other miscellaneous charges. It is important to factor these costs into your budget when considering becoming an estate administrator in North Dakota.

Furthermore, there may be other charges that are applicable depending on the type of estate being handled and any debts or taxes owed by the deceased individual. Before applying to become an estate administrator in North Dakota, it is essential that you understand all of the associated costs so that you can properly plan ahead.

When it comes to probating family businesses or farms in North Dakota, there are a few special considerations that should be taken into account. First, estate administrators need to be aware of the state's laws for intestate succession, which govern how property is distributed when someone dies without leaving a valid will.

Additionally, all assets must be properly valued and taxes have to be paid appropriately. In addition, if the deceased left any type of trust behind, an experienced attorney can help ensure that the terms of that trust are followed.

Finally, it is important to understand North Dakota's homestead legislation, which allows surviving spouses and minor children to remain in their home even after the death of their loved one. Estate administrators need to take all of these special considerations into account when handling family businesses or farms during probate in North Dakota.

When purchasing property from an estate during probate in North Dakota, there are certain restrictions that must be taken into account. According to North Dakota state law, the estate administrator is responsible for obtaining a court order that allows them to distribute the estate's assets.

In addition, the administrator must also provide notice to all creditors and beneficiaries, as well as obtain all necessary appraisals for the estate. Before any property can be sold, the administrator must obtain approval from the court and provide proof that all debts have been paid and creditors have been notified of their rights.

Furthermore, sales are subject to market value and taxes must be paid on any income generated from the sale of estate property. Finally, real estate transactions require a title search and deed transfer in order for property to be legally transferred from an estate.

As such, it is important for those purchasing property from an estate during probate in North Dakota to understand and adhere to these restrictions in order to ensure a successful transaction.

If someone has passed away and you want to know if they had a will in North Dakota before their death, the best place to start is by consulting with an estate administrator. An estate administrator can provide guidance on how to find out if the deceased had a will in North Dakota.

The process of becoming an estate administrator in North Dakota is outlined step-by-step below. Firstly, you must be at least 18 years old and have the legal capacity to represent the deceased's estate.

Secondly, you must complete an application form and submit it to the court clerk's office in your county. Thirdly, you must attend a court hearing where a judge will decide whether or not you are eligible to serve as an estate administrator.

Finally, once approved by the court, you will obtain Letters of Administration from the clerk's office that verifies your position as an estate administrator. It is important to get professional guidance from an experienced attorney when completing these steps as they can help ensure that everything is filled out correctly and filed properly with the court.

If an executor or a court makes a decision regarding an estate in North Dakota that you disagree with, it is important to know your rights as an interested party. Depending on the type of dispute, there are different steps you can take to challenge the decision.

If the dispute is related to the administration of an estate, such as who receives assets or how finances are handled, then it is best to start by filing a formal objection in writing with the court. You should include detailed information about why you disagree with the decision and be prepared to attend court hearings if necessary.

If your dispute relates to matters of inheritance law, then it is best to consult a lawyer familiar with North Dakota probate laws. In either case, understanding your rights and gathering evidence is key before taking action.

Having a thorough knowledge of the step-by-step guide for becoming an estate administrator in North Dakota can help ensure that all disputes are resolved fairly and efficiently.

It is possible to use alternatives to traditional probate in North Dakota when going through the process of becoming an Estate Administrator. For example, a Small Estate Affidavit can be used for estates with a gross value of less than $50,000.

This affidavit allows the estate owner to appoint an individual as administrator without going through the formal and lengthy probate process. Additionally, property owners in North Dakota can also transfer their assets into living trusts which help avoid probate court.

Living trusts can be revocable or irrevocable and are often used by individuals who wish to control how their property will be distributed after they die. Beneficiaries of these trusts can access the trust assets without any delays or additional fees associated with traditional probate in North Dakota.

Furthermore, joint tenancy ownership is another way to avoid the probate process as it allows an individual's property to pass automatically to a surviving joint tenant upon death without the need for probate proceedings. When becoming an Estate Administrator in North Dakota, understanding all of these alternatives is essential so that you can make informed decisions about how best to proceed with the administration of your estate.

Becoming an estate administrator in North Dakota is no easy feat, and transferring real estate without going through probate can be even more challenging. To help those who are interested in pursuing a career as an estate administrator, we have created a step-by-step guide that outlines the specific requirements for this role in North Dakota.

The guide also provides valuable information on how to transfer real estate without having to go through the process of probate. Firstly, it is important to understand the laws surrounding the transfer of real estate in North Dakota, including any tax implications or legal liabilities that may arise from such a transaction.

It is also necessary to consider if there are any restrictions on the types of property which can be transferred and whether these restrictions vary from county to county. Additionally, one must take into account any documentation that may be required when transferring real estate such as title deeds and other important paperwork.

Finally, it is always advisable to seek professional advice before engaging in any kind of real estate transactions to ensure that all parties involved are protected and well informed about the process. Estate administrators in North Dakota will find our step-by-step guide extremely helpful when it comes to navigating the complexities of transferring real estate without having to go through probate court.

When probating an estate in North Dakota, all types of assets must go through the same process. This step-by-step guide to becoming an estate administrator outlines the necessary steps to ensure that a decedent's assets are properly handled.

The process begins with identifying and locating all of the deceased person's assets. This includes any real estate, bank accounts, investments, life insurance policies, and other tangible property.

Once the assets have been identified, they must be valued and appraised to calculate their fair market value. After this is complete, creditors must be notified and then claims against the estate can be made.

The next step is to pay any debts or taxes that may be owed by the deceased person as well as any fees associated with administering the estate. Finally, once all debts have been paid and all other complications resolved, the remaining assets can be distributed to any beneficiaries that may have been listed in a will or trust document.

Becoming an estate administrator in North Dakota requires diligent attention to detail and knowledge of state laws regarding probate matters.

Inheritance taxes are a major concern for estate administrators in North Dakota, so understanding the laws and regulations surrounding them is important. Fortunately, the state of North Dakota does allow for several ways to avoid inheritance taxes when passing on an estate.

These include methods such as gifting money before death and utilizing trusts. Gifting can be done during one's lifetime to reduce the taxable value of an estate after death, while trusts can be used to bypass probate and avoid certain taxes.

Furthermore, North Dakota offers exemptions for certain categories of beneficiaries that can also help to reduce or eliminate inheritance taxes. It's important for estate administrators in the state to know these details in order to best serve their clients and ensure that their estates are passed on with minimal taxation.

In North Dakota, the process of disinheriting a beneficiary from an estate requires a few specific steps. First, the estate administrator must ensure that the will is accurate and up-to-date.

If there are changes to be made, they must be done in accordance with North Dakota state law. The next step is to file a petition with the court system requesting that the beneficiary be removed from the estate.

This petition must include evidence that proves why this action should be taken. Additionally, all legal heirs must be properly notified of the proceedings and given an opportunity to object if they choose to do so.

In order for a beneficiary to be successfully disinherited from an estate in North Dakota, all parties involved must agree upon this action and sign relevant documents in order for it to become official.

In North Dakota, surviving spouses have certain legal rights when it comes to inheriting assets from a deceased partner. If a person dies without leaving a will, their surviving spouse has the right to choose which assets they want to receive in the estate.

Additionally, if the deceased had created a will, but did not specifically mention their spouse in it, they may still be entitled to inherit some of the assets depending on how many beneficiaries are listed and how much of the estate each beneficiary is receiving. Moreover, if an asset was owned jointly by both spouses prior to death, then the surviving spouse has an automatic right to that asset regardless of any other terms stated in the will.

Lastly, if there is no will or other instructions for distributing an asset within an estate, then the surviving spouse generally has first claim over it.

Informal administration of an estate in North Dakota follows the same general process as formal estate administration, but is much less demanding and does not require court approval or supervision. The decedent's will, if any, must be filed with the court along with a petition for informal administration.

After that, the appointed personal representative must collect and inventory the assets of the estate and pay all debts through either cash or liquidation of assets. North Dakota law also requires personal representatives to provide notice to all heirs and beneficiaries of the estate.

Once all debts are paid and creditors have been notified, the personal representatives can distribute the remaining assets according to instructions outlined in the decedent's will or state law. Becoming an estate administrator in North Dakota is a straightforward process that can be completed without engaging legal counsel; however, it is important to understand what is involved before proceeding with informal administration.

In North Dakota, the probate process is triggered when the estate of a deceased person has assets in excess of $50,000. The court will appoint an estate administrator to manage and distribute the estate according to the law.

An estate administrator must be familiar with North Dakota probate laws and be able to provide guidance for beneficiaries throughout the probating process. Before undertaking this role, it is important to understand what is involved in becoming an estate administrator in North Dakota.

This step-by-step guide will provide insight on how much does an estate have to be worth to go to probate in North Dakota and what steps are necessary for becoming an successful estate administrator.

Probate is a legal process where an estate must be administered by a personal representative, typically an estate administrator or executor.

In North Dakota, probate is generally required for any decedent's estate that includes real property or tangible personal property.

The steps of the probate process are outlined in North Dakota law and include filing a petition for probate to open the estate, identifying and notifying heirs and creditors, inventorying assets and liabilities, paying debts, taxes and other expenses from the estate's assets, distributing remaining assets to the heirs, and closing the estate.

Estate administrators in North Dakota must be familiar with the laws governing estates in order to fulfill their responsibilities properly.

The cost of probate in North Dakota can vary widely, depending on the size and complexity of the estate. Generally speaking, it is common for the cost of probate to be between 4% and 10% of the value of the estate.

Additionally, any debts, taxes, and court costs must also be taken into consideration when calculating the total cost of probate. Before beginning probate proceedings in North Dakota, it is important to consult an experienced estate administrator who will be able to guide you through the process and provide an accurate estimate of all associated costs.

An experienced estate administrator in North Dakota will also have knowledge about any potential tax credits or deductions that may help reduce the overall cost of probate.

A: Generally, if a decedent's Last Will and Testament or Revocable Living Trust appoints the devisee as administrator, then the devisee may file the appropriate documents with the North Dakota court to become administrator of the estate.

A: A Trustee must apply for Letters of Administration with the court in the county where the decedent resided. The application must include the original will, if any, and a death certificate. If applicable, bond may also be required.

A: In order to become an administrator of an estate in the State of North Dakota, you must file a document with the appropriate court in one of the state's jurisdictions. The document should include details about any joint tenancy with right of survivorship held by the deceased, as well as other information related to estate planning.

A: To become an administrator of an estate in North Dakota, you would need to possess at least a high school diploma or GED. You may also need to take additional courses or obtain certifications related to estate administration. Depending on the complexity of the estate, you may need to be licensed as a fiduciary. Experience in dealing with estates is recommended. Networking with professionals such as attorneys and accountants can be beneficial when looking for opportunities within the field.

A: When becoming an administrator of an estate in North Dakota, the devisee can be assured that all communication will remain private. The State of North Dakota has a strict Privacy Policy in place which ensures that all messages sent and received by the devisee are secure and confidential.

A: An administrator of an estate in North Dakota must have a fidelity bond and it must be renewed on an annual basis. This bond provides coverage for losses due to any fraud, misappropriation, or neglect by the administrator with respect to the handling of estate taxes, debts, and other matters.

A: To become an estate administrator in North Dakota, you must gain knowledge of North Dakota laws, complete necessary education and training, obtain licensure and certification. A step-by-step guide to becoming an estate administrator in North Dakota can be found online.