Initiating a probate in Alaska is relatively simple. The first step is to contact the person designated as the personal representative or executor of the estate.

If no such individual has been appointed, then an appropriate party must file an application with the court to have an executor appointed. Once that is done, the executor will need to notify all heirs and beneficiaries of the estate.

The court will require proof that this notification was given before any other steps can be taken. After that, the executor must collect all documents related to the decedent's property and debts, including deeds, titles, mortgages, tax returns, and loan documents.

Then they must determine how each asset should be distributed among family members and creditors. Finally, they must submit a petition to the court for approval of their proposed distribution plan.

The entire process can take anywhere from a few months up to two years depending on the complexity of the estate and any disputes between claimants.

When filing a probate case in Alaska, it is important to understand the necessary documents that must be submitted. These include a Petition for Probate, an Inventory of Property, Letters Testamentary, a Notice of Appointment of Personal Representative, and an Order for Probate.

In addition to these documents, you may also need to provide the original will (if one exists), death certificates of the deceased person, and any other relevant paperwork. It is important to take into account all of these documents when filing a probate case as they help ensure that your rights as an executor or personal representative are protected.

Make sure you have all necessary forms completed and notarized correctly before submitting them for consideration by the court. With proper preparation, you can help ensure that your request for probate is handled efficiently and quickly.

Obtaining a certified copy of a death certificate in Alaska is an important part of the probate process. All property and assets must be accounted for, and these documents provide the necessary proof that a deceased individual has passed away.

To obtain such a document, the executor or administrator of the estate must fill out an application form and submit it to the Alaska Bureau of Vital Statistics. The form must include information about the decedent, including their name, date of birth and place of death.

Once submitted, the application will be reviewed by a Vital Statistics staff member who will determine if a certified copy can be issued. The fee for obtaining such documents may vary depending on how quickly they are needed, but it is usually $20 USD.

It is important to note that only someone with legal authority to act on behalf of the estate can apply for this document; any family members or friends wishing to do so must first receive written consent from either the executor or administrator.

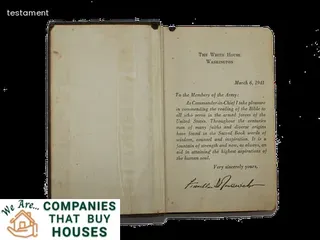

Probating a will in the state of Alaska is an important process, and part of that process requires having an original copy of the will. Depending on the circumstances, this may be necessary even if there are other copies or versions of the will.

It is important to be aware that any variation from the original document could be rejected by probate court, so it is essential to have an original copy available. The main challenge for most people when trying to probate a will in Alaska is locating the original document.

This is especially true when the decedent had no family members or other individuals present at their death. In these cases, it is often necessary to conduct a thorough search in order to track down all relevant documents related to the estate and its assets.

It can also take some time to obtain court approval before probate can begin, making it essential to make sure all documents are in order before filing them with the court. By understanding these requirements and taking steps early on to ensure all documents are properly formatted and located, you can avoid delays in your real estate and probate process in Alaska.

When considering the legal alternatives if an original will already has been submitted elsewhere, it is important to understand that Alaska real estate and probate laws are very specific on the matter. Depending on the situation, an individual may be able to have a court issue a duplicate will or be able to pass title through an affidavit of inheritance.

If a copy of the original will can be located, another option could be to petition the court for probate based on that version. Additionally, if there are no other legal documents that can be used to establish ownership and title, then a lost heir search may need to take place in order to determine who should inherit the property.

It is wise to consult with an attorney experienced in Alaska real estate and probate law who can provide guidance on which option is best suited for you and your family.

Probate without a will is a process in Alaska real estate that requires legal action to transfer the rights of ownership of property from an individual who has died without leaving a will. When there is no will, the court must appoint someone to take on the responsibility of distributing assets, and this role is referred to as an administrator.

The administrator must collect all assets, pay all outstanding debts and taxes, and then distribute any remaining assets according to Alaska's laws of intestate succession. This process can often be complicated and lengthy due to the need for multiple filings with courts and government agencies.

It is important to understand all aspects of probate without a will in order to make sure that the deceased's wishes are carried out correctly and efficiently.

To be eligible to serve as a personal representative in Alaska, one must meet certain qualifications. Firstly, they must be at least 18 years old and have the capacity and willingness to serve in this role.

Additionally, they must be either a resident of Alaska or have an attorney in the state. The personal representative is responsible for collecting all assets belonging to the decedent's estate and administering them according to the terms of the will.

They must also ensure that creditors are paid, taxes are filed, and any remaining debts are discharged. Furthermore, they are tasked with distributing any remaining assets to beneficiaries according to the will, or if there is no will then by intestate laws.

Finally, it is their responsibility to file an inventory of all assets with the court within 90 days of being appointed as personal representative.

The Alaska Probate Code requires that the Personal Representative of an Estate must provide a bond in order to be appointed. The amount of the bond is determined by the Court, based on factors such as the size and complexity of the Estate.

In some cases, a bond may not be needed if there is no risk to the estate assets or beneficiaries. The bond must be issued by a surety company that is authorized to do business in Alaska.

It is important that the Personal Representative understand their responsibilities and obligations under Alaska law before they apply for appointment and provide a bond. In addition, they should carefully read all documents related to the bond requirement, such as forms and instructions, before signing them.

When dealing with Alaska real estate and probate, knowing when you can waive the bond requirement is important. Generally, a bond is required if an executor or personal representative needs to be appointed to oversee the estate.

However, in the case of intestate estates (estates without a will) or cases where all heirs and devisees agree to the appointment of a personal representative, no bond may be necessary. All parties must agree to waive the bond requirement before being approved by the court.

It's important for all parties involved to understand that waiving the bond does not mean that any party will be released from their duty as fiduciary for securing and managing assets of an estate. Everyone is still expected to fulfill their responsibilities as outlined in Alaska statute.

Furthermore, it's essential for all parties involved in this process to obtain legal advice from a lawyer who specializes in probate law before signing away any rights associated with their interest in an estate.

When filing for a bond requirement in Alaska real estate and probate, it is important to be aware of the process. You must first submit a petition to the court, which should include all pertinent information such as the name of the estate and its beneficiaries.

The court will then review your petition and determine if a bond is needed. If so, you will need to file a financial statement showing that you have sufficient funds to pay any debts or liabilities that may arise from the estate.

Furthermore, you will need to provide an official surety bond or cash deposit depending on what the court requires. Lastly, you must provide proof that all parties involved have given their permission for your appointment as executor.

Following these steps properly is essential in order to ensure that everything goes smoothly with your probate case in Alaska real estate.

The process of reclaiming the bond is one of the most important aspects of post-probate real estate in Alaska. The probate court will assign a personal representative to oversee the estate and make decisions on how to handle it.

They are responsible for ensuring all taxes, debts, and other obligations are paid from the estate before any assets are distributed. Depending on the size of the estate, a probate bond may be required in order to protect creditors from potential losses.

This bond acts as an insurance policy for those involved in the probate process and must be paid back if any funds are misused or not properly dispersed. In order to reclaim this bond after going through probate proceedings, you must provide documentation that includes information about how much was paid out by the personal representative, how much money was recovered, and what liabilities remain unpaid.

Once all paperwork has been verified, you can submit a petition to have your bond returned. Although it may take some time for the court to review your petition and release your funds, having them returned is essential for those who want to move forward with their real estate investments in Alaska.

When petitioning a personal representative to post bond, there are several essential elements that must be taken into consideration. In the state of Alaska, heirs, beneficiaries, and creditors are required to post a bond in order to receive their share of an estate’s assets.

This process is referred to as probate and can be complicated if done incorrectly. Before proceeding with the petition, it is important to understand the key differences between an heir, beneficiary, or creditor.

An heir is someone who has been named in a deceased person’s will while a beneficiary is someone who stands to benefit from the decedent’s property. A creditor is someone who holds either unsecured or secured debt against somebody else’s estate.

Depending on their status as an heir, beneficiary or creditor, individuals must meet certain requirements when filing for a bond on behalf of an estate. It is also important to have knowledge of the laws surrounding real estate and probate in Alaska in order to successfully receive one’s rightful inheritance or payment from an estate.

When going through the probate process, it is important to notify all relevant parties as soon as possible. Alaska real estate and probate law requires that relatives, creditors, and other interested parties be notified of an estate's probate proceedings.

This includes any beneficiaries named in a will or trust, along with anyone who may have a legal interest in the estate such as those with a claim against the deceased. Notifying these parties within the required time frame is essential in order to ensure that all interested parties have sufficient notice of the proceedings and an opportunity to contest them if necessary.

Additionally, potential creditors must be identified and notified so that they can make claims against the estate for any outstanding debts or liabilities. It is also important to remember that notification requirements vary from state to state, so it is important to make sure you are familiar with Alaska's specific laws when handling a probate case.

When it comes to real estate and probate in Alaska, there are certain methods that must be used to provide notice to any individuals involved in the process. This could include family members, creditors, or other parties who may have a financial interest in the property.

The most common way of providing notification is through personal service. This involves delivering the documents directly to the individual involved in person or by registered mail.

Additionally, if all parties reside in Alaska, publication notices can also be used. This involves publishing the notice in a local newspaper of general circulation within the county where the real estate is located.

Another option for providing notice is by posting it on the property itself or sending it via certified mail with return receipt requested. Lastly, a court hearing can also be held wherein an attorney will represent all parties and provide them with formal notification of their interests in the real estate or probate proceedings.

When it comes to Alaska real estate and probate, there are certain circumstances in which the right to waive notice can be exercised. This means that under some conditions, a person may forgo their right to receive notification of an action or proceeding concerning the estate in question.

To do so, they must provide written notice of their intention to relinquish said rights, and this waiver must be filed with the court overseeing the probate matter. In some cases, the waiver may include other persons who will also be waiving their right to notification.

There are various legal considerations that should be taken into account when evaluating whether or not a waiver is appropriate. These include the specific details of the estate in question as well as any applicable statutes or regulations related to how such matters should be handled.

It is important to remember that waivers of notice must always remain in accordance with applicable laws and regulations in order for them to have any legal bearing on an estate or probate case.

When a probate is opened in Alaska, it’s important to understand the implications of real estate, as they can have a significant impact on the process. As part of the probate process, an executor or administrator must determine whether the decedent owned any real property and then determine who should receive it after death.

In some cases, if the decedent had a will, the property can be distributed according to that document. Otherwise, all real estate must go through probate court for distribution.

Depending on how the assets are managed, it can take longer for the probate process to be completed in cases where real estate is involved. Additionally, there may be costs associated with selling or transferring ownership of real estate during probate proceedings in Alaska.

Therefore, having an understanding of how real estate works within Alaskan probates is essential for resolving disputes related to a decedent's estate.

When dealing with Alaska real estate and probate, it is important to understand the state and federal tax guidelines associated with the process. In Alaska, both a personal representative and an heir may be liable for inheritance taxes.

The state also requires a fiduciary income tax return to be filed if there are assets held in trust. It is also important to note that any capital gains on the sale of real estate must be reported on both your state and federal tax returns.

On the federal level, estates are subject to various taxes depending upon the size of the estate, including estate taxes and gift taxes. Understanding these regulations can help to ensure that all assets are appropriately taxed during the probate process.

When it comes to Alaska Real Estate and Probate, it is important to understand what property is exempt from probate in the state.

In Alaska, certain types of property are exempt from probate, including: personal effects such as clothing and jewelry; vehicles; certain accounts such as Individual Retirement Accounts (IRAs); life insurance policies with designated beneficiaries; jointly owned real estate; and other assets that have designated beneficiaries.

When a person passes away, these assets will pass directly to the named beneficiary without having to go through probate court.

It is important to make sure that your beneficiaries are listed correctly on any accounts or documents in order for them to be exempt from probate.

In Alaska, the value of an estate must exceed $100,000 in order for it to be subject to probate. Probate is a court-supervised process that is used to make sure all debts from the deceased's estate are paid and the remaining assets are distributed according to the wishes of the deceased.

It includes filing paperwork with the court and providing notice to creditors, beneficiaries and other interested parties. When there is real estate involved in an Alaska probate case, it may be necessary for a personal representative or executor to manage and maintain the property until it can be sold or transferred as dictated by the will.

This could involve collecting rents, making repairs, etc., which can require additional time and cost on top of what is already necessary in probate proceedings.

Knowing how much an estate must be worth before being subject to probate in Alaska is crucial for those dealing with real estate after a loved one has passed away.

Probate is the process of settling an estate after someone passes away. In Alaska, there are a few steps that can be taken to avoid probate, helping heirs and beneficiaries to access funds and assets quickly.

One way to avoid probate is by setting up a trust. Trusts provide a legal way of designating who will receive funds after death without going through the court system.

Joint ownership of assets is another option that avoids probate by allowing two or more people to own an asset together with right of survivorship. This means that when one owner dies, the other person automatically becomes the sole owner without having to go through probate.

Other ways to avoid probate in Alaska include putting titles in beneficiary form, using payable-on-death accounts, and naming beneficiaries on retirement accounts. With careful planning and the help of an experienced real estate attorney, it's possible for Alaskans to reduce or even eliminate their estate's time spent in probate court.

When it comes to real estate and probate in Alaska, there are two primary types of probate: formal and informal. Formal probate is a process that is supervised by the court, while informal probate can be done without court intervention.

In formal probate, the court appoints an executor or administrator to handle the deceased's estate. This person will be responsible for gathering assets, paying debts and taxes, and distributing remaining assets according to the will or state intestacy laws.

The executor or administrator must also file all required documents with the court and provide notice to all interested parties such as creditors, heirs, and beneficiaries. Informal probate on the other hand is handled privately between family members without court involvement.

This type of probate is typically used when there are no disputes among family members regarding how assets should be distributed from the estate. With informal probate, an individual can act as their own executor of the estate, which can be beneficial in minimizing costs associated with legal fees.

However, it is important to note that some counties may require formal probate even if there are no disputes among family members.